Lodge & Resort Selling Price Vs Asking Price Ratio

The selling-price to asking-price ratio, expressed as a percentage, is one of the most important statistics available. Sold to ask ratio is simply calculating the percentage of asking price that a property sells for. For example, if you have a lodge that is listed for $800,000 and it sells for $710,000, the sold to ask ratio is 89%. Below is the calculation used:

Sold price divided by Asking price = Sold to ask %

For Lodge & Resort Buyers:

Knowing this ratio provides an indication of how much can be negotiated off the average asking price so that expectations are kept within a reasonable range, and so that time is not wasted viewing properties that are priced out of reach.

For Lodge & Resort Sellers:

Knowing this ratio helps determine how accurate other lodges & resorts listed for sale are in their asking price. The ratio also tells sellers how much “fat” is required in the asking-price based on how much buyers are negotiating off.

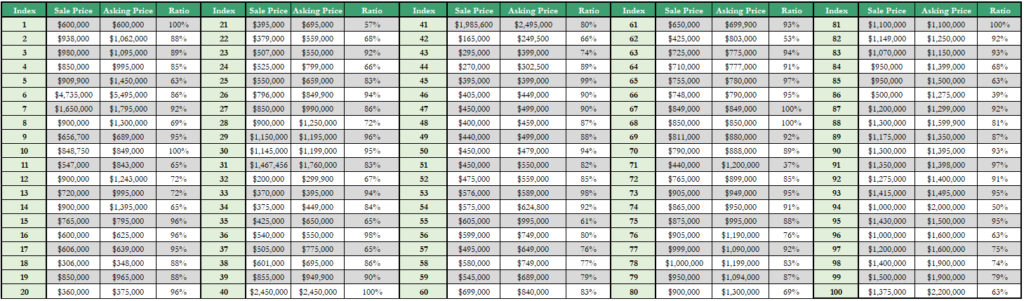

Here’s an example of 100 lodge & resort sales showing the selling-price to asking-price ratio:

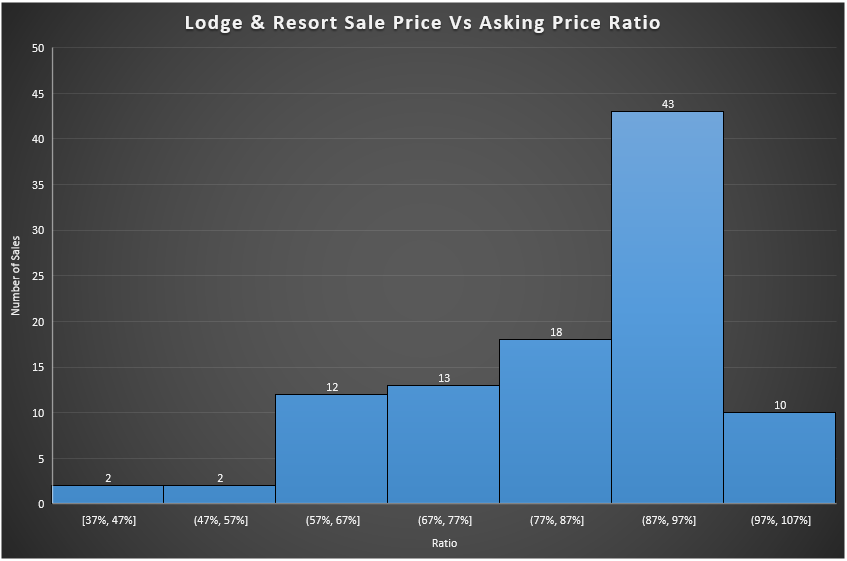

Distribution of Lodge & Resort Sale Vs Asking Price Ratios

The below distribution histogram, shows the distribution of sale vs asking price ratios:

- The histogram shows that the most common range of sale ratios is between 87% to 97% (43 of the 100 sales fell within this range).

- Almost half (47 of the 100 sales), sold for less than 87% of their asking price.

- Nearly a third (29 of the 100 sales), sold for less than 77% of their asking price.

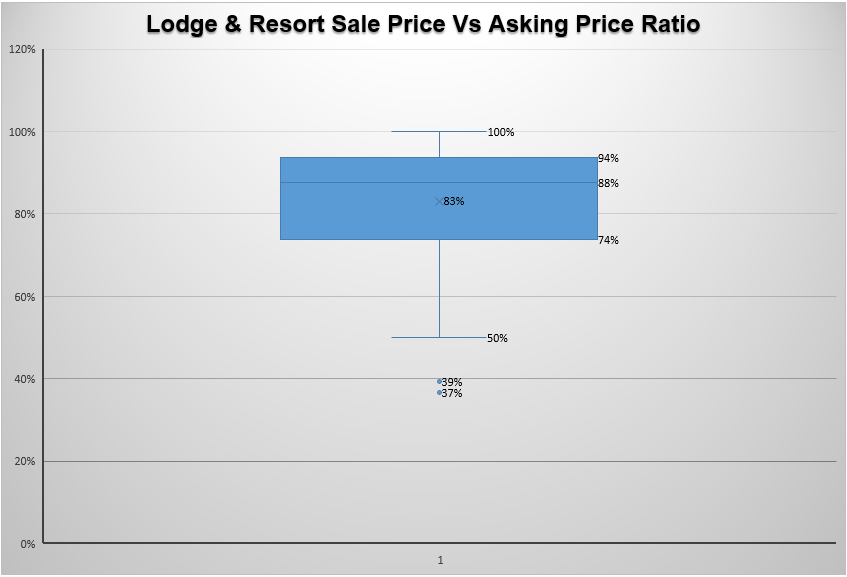

Typical Range of Lodge & Resort Sale Vs Asking Price Ratios

The box and whisker plot below helps visualize the distribution of sale ratios and whether there are potential unusual observations (outliers) in the data set:

- The median sale price is 88% of the asking price as indicated by the line in the blue box.

- Half of the sales were for between 74% and 94% of the asking price as indicated by the top and bottom of the blue box.

- A quarter of the sales were for between 50% and 74% of the asking price as indicated by the bottom of the blue box and the lower whisker.

- A quarter of the sales were for between 94% and 100% of the asking price as indicated by the top of the blue box and the upper whisker.

- Two outliers sold for 37% & 39% of their asking price.

Don’t Be an Outlier

The likelihood of selling near the median (88% of the asking price) is determined by how realistic the seller was in setting the asking price. For comparison purposes, most home sales are 95% of the asking price, in hot real estate markets the ratio might even be over 100%.

As the data has shown, setting the asking price for a lodge or resort is difficult. This is due in part to there being an arguably wider range of buyer motivations than any other type of real estate. Some examples of buyer motivations are:

- Investment return focused buyers

- Owner operators only seeking to earn an average income and enjoy the lifestyle

- Wealthy / Special Interest buyers

It’s not possible to predict a lodge or resort’s market value with the same precision as a house, but it can be estimated within a relatively narrow range. Where the actual sale price lands within the range is determined by who the most likely buyer is and how long the seller is willing to wait.

Most lodge & resort sales are being done to help finance the seller’s retirement. For this reason, they are often priced at the very top end of their potential market value, in line with what a wealthy or special interest buyer might pay (even though these buyers make up less than 10% of the market).

Most sellers are willing to wait years to hopefully find one of these buyers, but the reality is, owner operators needing to earn an immediate income from the property make up the majority of buyers.

Basing decisions on asking prices is risky with lodges and resorts. If you want to ensure you’re not one of the outliers selling for less than 74% of your asking price, I recommend getting your lodge or resort appraised, or at the very least getting your hands on some solid comparable sales data before setting your asking price. Conversely, if you’re a buyer and want to ensure you’re not overpaying, getting your hands on some solid sales data can be invaluable.

This article has been prepared by Frontier Hospitality Advisor for general information only. Frontier Hospitality Advisor makes no guarantees, representations or warranties of any kind, expressed or implied, regarding the information including, but not limited to, warranties of content, accuracy and reliability. Any interested party should undertake their own inquiries as to the accuracy of the information. Frontier Hospitality Advisor excludes unequivocally all inferred or implied terms, conditions and warranties arising out of this article and excludes all liability for loss and damages arising there from.

I am thinking of buying a moose hunting lodge in or around Badger NFLD. Price range $500.000.00 to $ 650.000.00

I live in Ontario and retired.

The plan would be to manage 6 hunters each week for the Moose season with guide and accommodations with inhouse cook.

I think you could get a good property in that price range. You should post some of your purchase criteria in the wanted ads section of the website, that usually generates a few leads from owners of not publicly advertised lodges that are for sale.