The Highest Lodge Net Profit Margin I Have Ever Seen

Net profit margin is the amount of revenue left over after accounting for expenses and is expressed as a percentage.

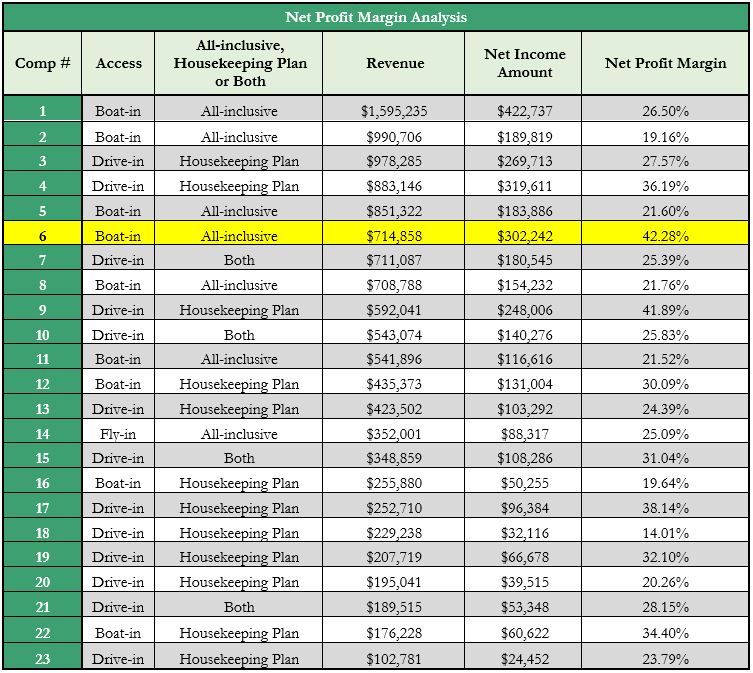

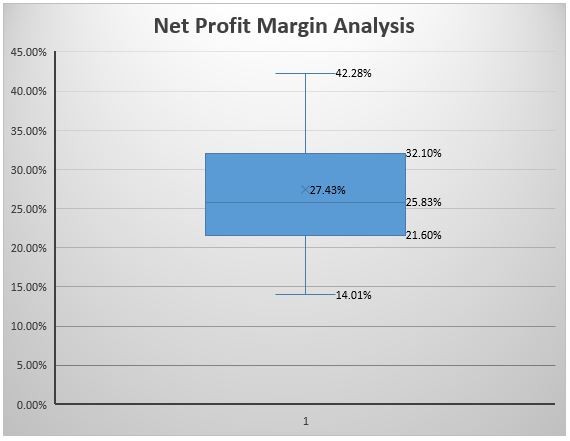

The below graph displays the typical net profit margin for a lodge operation:

- the ends of the blue box are the upper and lower quartiles

- the median is marked by the vertical line inside the blue box

- the whiskers are the two lines outside the blue box that extend to the highest and lowest observations.

Net profit margin will fluctuate from year to year, but as displayed in the graph above it usually averages out to around 25%. 50% of the lodges in the data set have net profit margins between 21.60% and 32.10%.

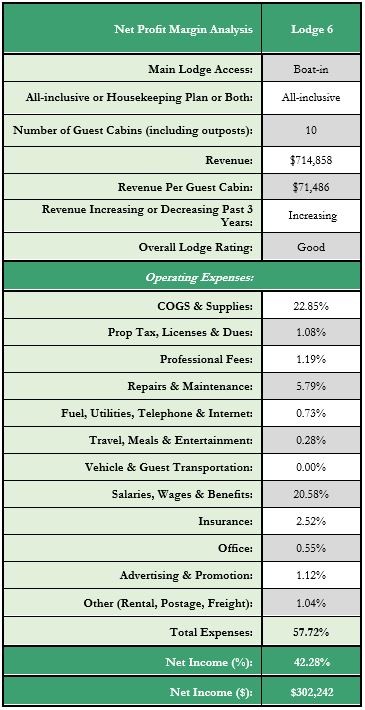

The Highest Lodge Net Profit Margin I’ve Observed:

The highest net profit margin I’ve seen a lodge perform at is 42.28%. The lodge is boat-in access, approximately 30 minutes from a landing site outside a small community. There is a large city centre a few hours away and it is in close proximity to the US border.

The lodge offers good quality facilities. Guests primarily purchase all-inclusive packages. The waterbody it is located upon has a lot of recreation use which drives significant revenue to the lodge’s public restaurant. The business is open May to September.

Problematic Lodge Expense Areas:

Growing Labor Costs

Labor costs and cost of goods sold are the two largest lodge operating expenses. With the raising of minimum wage, the lodge industry has experienced a significant increase in labor cost growth the past few years. Given their often-remote locations and seasonality, lodges have to increase compensation levels in an effort to remain competitive with other industries to attract employees.

Rising Fuel & Utilities Costs

Rising fuel costs affect the expense of guests travelling to the lodge as well as the cost of operating recreational equipment once they get there. Many remote lodges operate off of gas fired generators and rising fuel costs increases the expense of operating the lodge itself.

Utilities can have a massive impact on a lodge’s profit. Even before the global pandemic tore through the lodge industry, utilities costs were the industry’s single fastest growing operating cost.

Food Price Inflation

Overall food prices are expected to increase 3% to 5% in 2021, according to the 11th annual edition of Canada’s Food Price Report. Increases in food prices can have a major impact on the bottom line of lodges that offer all-inclusive packages. The traditional three-meal, all-inclusive package may be phased out. Taking its place will be more grab-and-go concepts for both breakfast and lunch.

Check Your Net Profit Margin:

It’s a good idea to regularly analyze your lodge’s net profit margin and look for areas to increase performance. Your net profit margin shows what percentage of your revenue is actual profit. This is after factoring in your cost of goods sold, operating costs and taxes. To calculate your net profit margin, divide your net income by your total sales revenue. The result is your net profit margin.

This article has been prepared by Frontier Hospitality Advisor for general information only. Frontier Hospitality Advisor makes no guarantees, representations or warranties of any kind, expressed or implied, regarding the information including, but not limited to, warranties of content, accuracy and reliability. Any interested party should undertake their own inquiries as to the accuracy of the information. Frontier Hospitality Advisor excludes unequivocally all inferred or implied terms, conditions and warranties arising out of this article and excludes all liability for loss and damages arising there from.