Special Interest Purchasers in the Fishing & Hunting Lodge and Resort Industry

It is the goal of any fishing & hunting lodge or resort seller to maximize the selling price.

From a buyer’s perspective, the alignment of the target business and his or her objectives will vary with each candidate. As a result, each buyer is unique in the price they are willing to pay for the business/property because of the distinctive manner in which they intend to utilize the assets.

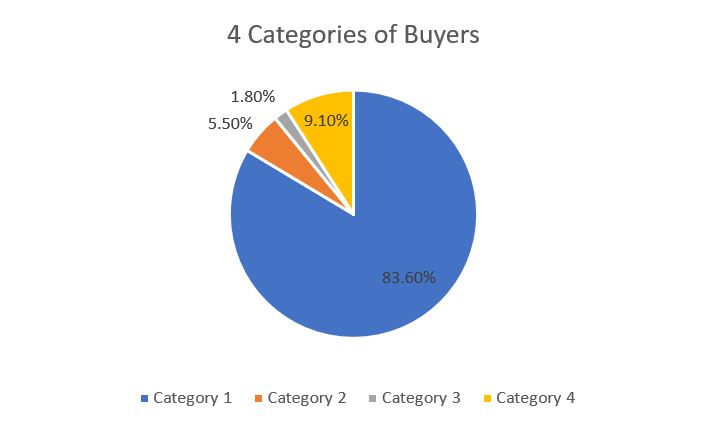

When it comes to fishing & hunting lodges and resorts, there are 4 broad categories of potential buyers:

Category 1: Owner-operators who will continue to run the business in a similar manner to earn their primary income.

Category 2: Passive investors who will hire a manager to run the business in a similar manner and expect a return on investment.

Category 3: Groups seeking to buy the property for conversion to an alternate use such as a family compound or developers that intend to subdivide or strata the property.

Category 4: Special interest purchasers:

- Large corporations seeking a corporate retreat.

- Current owners looking to expand their operation.

- Wealthy individuals, passionate about the industry and will run the lodge as a mix of a business and a place to entertain friends, family and clients and are happy to break-even.

It is logical that the largest pool of potential buyers generally set the market and establish the most likely price that will be paid.

Reviewing the last 100 lodge/resort assignments I’ve completed, the breakdown of ownership of the 4 categories above is as follows:

Category 1 - Owner Operators:

As displayed above, roughly 84% of lodges are owner-operated. If a larger sample size is taken, that number is likely even higher.

What I’m generally seeing from owner-operator buyers in the marketplace is they expect to earn an EBITDA that is 12% to 14% of the sale price where a well-established, viable business is in place. The lower end of that range would be properties with the potential to increase revenue with a few minor changes or very high-quality properties.

As long as a lodge or resort operation isn’t in distress, the real estate value sets the baseline or minimum that a lodge or resort will sell for. Just because the lodge doesn’t have a viable business in place and only earns $20,000 a year doesn’t mean it’s only worth $20,000.

A buyer will consider the potential revenue that could be generated if a better operator is in charge but this still leads to a purchase price near real estate value if a viable business isn’t in place at the time of purchase. It will be important to base the sale price on similar lodges that had little or no income. Two lodges that are similar in all respects, except one earns $200,000 in net income and the other earns $20,000 net income have very different values to an owner-operator.

Sellers who have only run the business on a casual basis often expect buyers to pay a price for their lodge or resort based on its potential revenue. Often, they’ll state the lodge could easily do $XXX,XXX in revenue and I’m often left wondering if it were so easy why don’t they do it. This expectation is the same as expecting to sell a fixer upper house based on its renovated value. The buyer is going to do all of the work to build the business up. Thus, they deserve to reap the rewards in the form of the increase in value.

It is important to value the operation based on similar physical qualities but also similar business performance.

Category 2 - Passive Investors:

A passive investor that intends to hire a manager and still wants a market level return on investment will be willing to pay the least for a lodge or resort operation.

Passive investors will find it difficult to find operations that will meet the minimum expected return that alternative passive investments might provide, especially when risk is taken into account.

A common saying is “no one gets into the fishing lodge industry to get rich”. A passive investor will need to recognize that they will need to take a “haircut” on their expected return to enter the resource-based tourism industry where sale prices are largely driven by passionate owner-operators rather than expected return compared to a passive investment.

Passive investors will be limited to highly motivated sellers and even then, the investment required to turn the business around in the highly competitive lodge/resort industry will likely offset any savings.

This is why passive investors seeking a market level return make up a small percentage of buyers.

Category 3 - Groups seeking to buy the property for conversion to an alternate use:

When discussing the real estate value of lodges and resorts, many owners will examine recreational properties in the area. If cottages in the area sell for around $300,000, they do the math as $300,000 multiplied by the number of cabins on their property.

When buying anything in bulk, such as a lodge or resort with 12 cabins, a significant discount is obtained for each individual asset included. This is the attraction for this type of buyer. They will pool funds with family or close friends and be able to each have an individual cabin at a cheaper price than buying separate properties.

Investors that intend to subdivide or strata a resort will realize a profit by completing a bulk purchase and then selling the individual properties at a higher price.

Groups seeking to buy a lodge or resort for conversion to an alternate use will generally be targeting properties where a non-viable business is in place. Their ideal property is one selling near its real estate value in its current use because they have no intention of continuing to operate it as a business.

Category 4 - Special Interest Purchasers:

Special interest purchasers will generally pay the most for a lodge or resort but as was established above, there is less than a 10% chance of this type of buyer coming along.

The reason most lodges sit on the market for 2+ years before selling for 20-25% below asking price, is because they are pricing the lodge based on special interest buyers and are willing to wait.

Many active industry participants have heard the story of a lodge selling for an astronomical sale price to a large corporation or wealthy individual purchaser because they fell in love with the property. The danger of placing too much emphasis in the asking price on the hope of a special interest purchaser coming along is the property will sit on the market for a long time which isn’t ideal.

The increase in value paid by special interest purchasers can often be attributed to the following:

- The ability of large corporations to integrate a lodge or resort into its existing business as a corporate retreat greatly reduces risk.

- Economies of scale as a result of the combination of two or more lodge/resort operations, at levels over and above the aggregate of the separately viewed businesses.

- The comparison in price of remote lodges and resorts compared to other vacation properties is seen as good value to wealthy individuals who are passionate about the outdoors.

- Some combination thereof.

When estimating market value of a lodge or resort, the assessment of special interest purchasers can be a complicated task. While it is frequently impossible to quantify special interest purchaser premiums with any certainty, it is necessary to understand that special interest purchasers do exist in the lodge/resort industry and there is some probability of a special interest purchaser price increment.

It is not acceptable to merely “assume away” special interest purchasers when setting the asking price. Fishing & hunting lodge and resort transactions are certainly reflective of some special interest purchaser activity. The difficulty is in estimating the probability for an individual property.

My experience has been that special interest purchasers are most likely to buy remote properties where they can largely have the lake and surrounding area to themselves. Properties that are turn-key, higher quality developments.

Conclusion:

In summary, an open market lodge or resort purchaser will review an acquisition candidate in relation to the incremental value likely to be enjoyed by the purchaser following acquisition.

If the lodge or resort is priced in line with the purchasing behavior of the largest pool of potential buyers it will still often take one to two years of market exposure to find a buyer at market value. This is because we are still talking about a very niche buying group compared to other real estate/business transactions.

It would be wise for current owners to consider what they as owner operators could afford to pay to earn a living and live the lifestyle, and ask for that to avoid sitting on the market for an extended period of time. Gather information on comparable properties that had similar EBITDA at the time of their sale and maybe add a slight premium to that price based on the probability of a special interest purchaser coming along.

This article has been prepared by Frontier Hospitality Advisor for general information only. Frontier Hospitality Advisor makes no guarantees, representations or warranties of any kind, expressed or implied, regarding the information including, but not limited to, warranties of content, accuracy and reliability. Any interested party should undertake their own inquiries as to the accuracy of the information. Frontier Hospitality Advisor excludes unequivocally all inferred or implied terms, conditions and warranties arising out of this article and excludes all liability for loss and damages arising there from.