Fishing & Hunting Lodge Industry Research Report

Preface

Canada’s fishing and hunting lodge industry is part of how we showcase our beautiful nation to the world. It shows our fellow Canadians, as well as international visitors, the beauty of our untouched wilderness.

These lodges are Canada, they are surrounded by our nation’s beauty. Some are more remote than others, however, all of them take us back to a lifestyle and an environment that tickles our soul and reminds us of the simpler times of our ancestors.

Looking around these lodges you will see pristine lakes, untouched wilderness and wildlife that can only be truly appreciated by being observed in this natural habitat. This beautiful scenery encourages visitors to leave their electronics at home and take a break to connect with nature again.

This report has been prepared to benefit Canadian Fishing & Hunting Lodge owners by supporting strategic business planning. It is also intended to provide sound research for Canadian Lending Institutions that provide services to Lodge operations in Canada as well as all other participants in this wonderful industry.

The Objectives of This Report:

Section 1 – To provide insight into the current health of the Canadian Tourism Industry.

Section 2 – To aid in understanding the current status of the fishing & hunting lodge sector.

Section 3 – To detail lodge differentiation tactics that are being utilized.

Section 4 – To explain and demonstrate observed patterns in lodge operations.

Section 5 – To describe successful strategies lodges are utilizing to increase revenue.

Section 6 – To provide Canadian fishing & hunting lodge sale listings for comparison purposes.

Section 7 – To detail the “New Angler” demographic profile for target marketing.

Section 8 – To discuss overall industry trends in 2018.

Section 9 – Final observations

Section 1: 2018 Canadian Tourism Industry Update

Canada’s vast and beautiful wilderness offers amazing landscapes that attract visitors from all over the world. This combined with our reputation as a safe place to travel makes us a world class destination.

While our country has long been an attractive destination for our neighbour to the south, it appears some potential American guests are preferring to travel within the US to avoid going through Customs and Immigration.

Tourism spending by Canadians within Canada grew 2% in the third quarter of 2017, compared with a 1.9% increase in the previous quarter. However, spending by international visitors to Canada declined during the third quarter of 2017, said Statistics Canada.

Overall tourism spending in Canada rose 1.5% in the third quarter of 2017 driven by tourism spending by Canadians at home, new data from Statistics Canada shows.

Growth in tourism domestically was driven largely by increased expenditures on passenger air transport, which grew at the fastest pace (6.1%) since the first quarter of 2011. Spending on food and beverage services (1.9%) and accommodation (1%) also increased during the quarter.

This increase was offset slightly by spending among international visitors to Canada, which decreased 0.4% in the third quarter of 2017 after edging 0.2% higher during the second quarter of last year. Lower expenditures on passenger air transport (-1.5%) accounted for most of the decline, followed by food and beverage services (-0.5%) and accommodation (-0.3%).

Visiting Canada is a common choice for American outdoor enthusiasts. However, Canada could be capturing a much larger share of these American outdoor enthusiasts. There are still more than 45 million Americans that fish; which represents approximately 16% of all residents over the age of 42.

More Americans fish than play tennis (10.4 million) or golf (24.4 million) combined. Further to this the Canadian Tourism Commission TAMS research suggested that American anglers were more likely than Canadian Anglers to stay in remote accommodations (fly in lodge or outpost camp).

The sport fishing and hunting tourism industry injects significant amounts of revenue into the Canadian economy every year. A study was completed on the Importance of Nature to Canadians (Federal-Provincial – Territorial Task Force), the study determined that Canadian and American visitors combined were currently spending tens of billions of dollars on outdoor-related activities in Canada.

The Ontario Federation of Anglers and Hunters has stated that Recreational Fishing and Hunting provides over $3 billion in annual economic activity in Ontario alone. The industry also provides job opportunities to our country and supports numerous other businesses through supplies purchases.

Understanding the current state of the overall Canadian tourism industry is important for lodge owners. By understanding the overall trends in tourism and the economic trends that impact the lodge industry, owners are able to make better strategic decisions. Below we will discuss in more depth the impact certain economic environments have on lodge occupancy.

Canada has been benefiting to the tune of tens of billions of dollars in revenue generated by outdoor related activities while operating at only a fraction of its potential.

Better national marketing programs showcasing our beautiful wilderness destinations to potential international visitors during healthy economic times, could lead to significantly increasing the outdoor tourism industry’s overall revenue production.

Section 2: Current Status of the Canadian Fishing & Hunting Lodge Sector

The Canadian overnight sport hunting and fishing sector has faced a series of external factors that have affected occupancy over the last decade.

Over the previous decade there was a consolidation of the lodges in the outdoors industry across Canada, with many lodges struggling to maintain occupancy levels and general profitability. Some lodges shut down indefinitely, while others stopped investing back into their businesses.

We have discussed the state of the lodge industry over the past decade with many lodge owners and circumstances varied. Some lodge owners took on other full-time work to offset the decline in their lodge operation’s revenue; others passed the lodge to children for them to operate on a part time basis.

A few lodge owners stated they were always operating the lodge as a “hobby” business, mainly for visiting friends and family and were as busy as they wanted to be over the past decade. Other lodges didn’t even notice a downturn.

There were many reasons for the decline in the overnight sport fishing and hunting sector that some lodges experienced beginning in approximately 2007 until 2014. Negative factors determined from our research and stated by lodge owners that led to the decline include:

Aging Anglers:

Reliable annual angler guests have aged and are not being replaced by younger ones at an adequate rate.

Decline in Corporate “Getaway” Guests:

The corporate market was once the “bread and butter” of Canada’s overnight lodge industry. This market dropped dramatically given the economic downturn, the restrictions on tax write-offs and the fact that fishing was not considered a gender neutral activity for companies. There are still some Canadian lodges exclusively catering to the corporate market today.

US Economic Recession:

Tourism is a discretionary expense, therefor it is particularly vulnerable to economic uncertainty and volatility such as that experienced following the 2008 Financial Crisis.During difficult economic times households conserve their money to cover the essentials of life, food, shelter and family necessities.

However, tourism does not completely stop, people continue to travel but they will travel differently from the way they do during times of economic buoyancy.In the short to medium term there is almost certain to be a trend of travelers spending less on travel.

Those tourism and hospitality businesses which can adapt to service travelers on a tighter budget will do well. The demand for the luxury end of the market decreases while demand for either low cost or perceived good value products and services grows.

Changes in American travel patterns post 9/11:

9/11 had numerous implications on tourist’s desires to travel. Despite the introduction of new security measures, air travel was still perceived to be unsafe. The terrorist attacks caused passenger numbers and occupancy rates to reduce significantly as tourists became reluctant to travel.

Unfavorable exchange rates:

The exchange rate, or the value of the Canadian dollar relative to the currencies of other countries, has a significant effect on tourism visitors to Canada.

The Canadian Tourism Commission found that a 10% increase in the value of the U.S. dollar increases Americans’ overnight travel to Canada by 3% to 4%.

In other words, a shrunken loonie encourages Americans to holiday in Canada, where their dollars are going much further than when the currencies were at par.

The above chart correlates very well with most Canadian Fishing and Hunting Lodge historical income statements we have analyzed, as well as verbal reports on their business operation history we have received in conversations with lodge owners.

A brief history of the exchange rate:

In 2002 the Canadian Dollar hit a record low of US $0.61 cents.

At the end of 2004 the loonie traded at US $0.87 cents. Canadians had not seen their dollar at US $0.80 or higher in more than in 12 years.

In 2006 the loonie topped US $0.90 cents. It then weakened for much of the rest of the year.

In 2007 the loonie topped US $0.94 cents – the highest level in 30 years. That fall the loonie hit its modern-day intra-day high of US $1.10, and hit its highest closing price of US $1.08. This is also reportedly when many lodges began seeing their business decline.

The loonie continued to trade near parity until it dipped below that level July 2008.

In 2009 the Canadian dollar closed at a recent low of US $0.76 before restarting a rapid ascent higher against the American Dollar.

In 2015 more than 3.3 million Americans came to Canada in the first five months of the year. This was at the time the highest level for that period in several years, but still short of the peak in 2002 when there were well over four million U.S. visitors. That year, the Canadian dollar fell to US $0.62. We have observed in income statements of lodges we served that this was a major turnaround year in their businesses with some of the strongest revenue numbers since the early 2000’s.

The Canadian dollar, which was over US $0.90 cents for all of summer 2016, fell below US $0.85 cents in January 2017, and has been under US $0.80 since early July.

The National Bank of Canada forecast for 2018:

Q1 2018: US $0.82

Q2 2018: US $0.83

Q3 2018: US $0.81

Q4 2018: US $0.78

Q1 2019: US $0.77

Higher operator costs:

There is angst among lodge owners across the country as they feel the combined blows of rising costs and a government tax squeeze. Whether it’s hydro, minimum wage, limiting the ability to set up corporations, all of these things are impacting lodge profitability and their viability as businesses.

Fishing and Hunting Lodges operate at pretty tight margins to begin with. Owners across the country are feeling the cumulative impact of decision-making from all three levels of government. New tax policies introduced by the federal government expose Canadian small-business owners to high tax rates. Those measures combined with the other factors mentioned, including rising labour costs and are forcing some lodge closures.

There is a lot apathy in the Canadian fishing/hunting lodge industry with many owners believing fishing/hunting is declining and there is nothing that can be done.

During the US economic recession that forced so many Canadian Lodges to close their doors, there was a small group of lodges that never experienced a decline at all. These lodges improved their operations and marketing in order to adapt. All other industries are actively marketing their product, the lodge industry should not think it is any different.

The above “doom and gloom” picture we painted applies mostly to those lodges who have already gone out of business or were sold and are now operating under new management.

Canada’s fishing/hunting natural resources are abundant. There is consensus amongst lodge owners that the quality of the sport hunting/fisheries are still in excellent shape.

The quantity of fish/game caught, size of fish/game, variety of species and general ease of fishing & hunting in Canada were never raised as issues through our research discussions with owners.

Angler satisfaction within Canada is still very high. Lodges are receiving high ratings on online surveys, with guests stating they enjoyed elements such as: shore lunches, the guides, lodge services and amenities.

The overnight sport fishing/hunting product is still viewed favorably, given the level of repeat business and the fact that visitor exit surveys indicate that over 90% would recommend the lodge they stayed at to others.

The tide appears to have turned in the industry the past 3 years with the far majority of lodge owners we have encountered stating that they are experiencing steady growth and profitability over this period.

This could be a case that “only the strong survived” the turbulent time period mentioned above. The tough economic times from 2007-2014 may have forced the remaining operations to become lean, efficient businesses and we may be now merely witnessing the results of those that were able to adapt. It could also be that the remaining lodges that survived the US recession are getting bigger share of a smaller pie.

Tourism has been strong in Canada the past few years but there also appears to be a positive trend emerging in the outdoors tourism industry specifically.

As technology shapes most of modern life, having the primal, basic skills of fishing and hunting is something that people are increasingly proud to showcase. Individuals are taking pride in harvesting their food themselves because the world is increasingly disconnected from its food sources. Mainstream nutritionists are also advocating eating wild game and fish for its health benefits.

As humans become more and more urbanized, life evolves further and further from that of our ancestors. There appears to be an emerging need to connect with a simpler way of life.

Canada’s lodge and resort industry is going to play an important role by providing a place to reconnect with our ancestor’s way of life and be a place to unplug from technology.

Section 3: Canadian Fishing & Hunting Lodge Differentiation Tactics

The diversity of fishing and hunting lodges, whether small, medium or large scale operations, offer a variety of options for outdoorsman visiting Canada. These lodges “offering’ varies in terms of the species of fish/animals, the overall experience, service and amenities.

We have researched the various lodge “positioning” options within the industry. This research considered the full spectrum of Canadian fishing & hunting lodges including small, medium and large scale lodges.

Very Remote:

Within the lodge industry, the “very remote” sector appeals to guests who are willing to pay up to twice as much as clients of road-accessible lodges.

This is likely due to the popular opinion that less accessible lakes have higher quality fishing experiences. Research supports this popular opinion and also indicates that when new roads are built to access previously remote lakes these lakes are “fished out” in a very short time frame.

Remote operations are especially dependent on U.S. customers. The remote fly in fishing/hunting lodge operators we interviewed stated that over 75 percent of their guests are American.

Remote fishing/hunting lodge guests are interested in observing Canada’s beautiful scenery, unique character and lifestyle, sampling local foods and taking in northern icons (i.e. bush planes, sunsets/rises, northern lights).

Lake Reputation:

The angler community is a tight knit one and having good credibility within it is a strong indicator of business success.

Just like your lodge can have a reputation for the quality of service and experience it provides, the lake that the lodge is on also develops a reputation within the angler community.

You cannot change the fish that your lake provides but you can spread the word of the quality of your fishery through social media.

If your lodge is not on a quality fishery, or one that is not producing the way it used to, it is best to reposition yourself to attract a different clientele because your angler guests will not return eventually no matter how good the service is.

Lodge Scale:

Small scale lodges are typically characterized as: being able to house less than eight guests, offer limited services/amenities, have steady fishing/hunting action with the potential for a few trophy-sized, and usually offer an unguided product. We have seen very few small scale lodge owners making upgrades to their infrastructure to keep it up to date.

Medium scale lodges often offer an American plan with three meals a day, a full service bar, internet, guiding at an extra cost, and some small luxuries like a wood fired hot tub or sauna. Many medium scale lodges are providing a quality product at a mid-range price point.

Large scale, “full service” lodges have been the backbone of the Canadian fishing & lodge for decades. Large scale lodges often can cater to large groups of up to 45 guests. Some lodges offer full amenities to a higher end client.

Large scale lodges cater more to the American market, their clientele is often made up of 90%+ US visitors. Most large scale lodges also catered extensively to the corporate market in the 1980s and 1990s. Many large scale lodges have a long history with a very strong base of repeat clientele.

Amenity Offerings:

Some lodges are offering a more rustic experience like that of an “outpost camp”. Clients usually book the entire facility and bring their own supplies.

Very basic amenities are provided, such as boats, motors and cooking supplies and one individual may be on site to provide an orientation and some basic support. Anglers/hunters are then left on their own to take care of themselves and fish/hunt on their own schedule.

The “do-it-yourself” lodge is becoming more popular. It keeps overhead low which means they are able to keep the price low and make a small profit.

Lodge Culture:

Most lodge owners have aimed to create a “culture” for their lodge that has a comfortable, laid back, family feel.

Guests fish at their own pace and on their own schedule. Guests of these lodges often speak of a sense of belonging, comfort, good food, simplicity, relaxation, camaraderie and of course great fishing. It’s these tangible and intangible elements that create the need for guests to come back year after year. They remember how they feel at the lodge, a sense of calmness they cannot obtain within city limits.

Section 4: Current Observed Fishing & Hunting Lodge Patterns in Operations

The Fishing/Hunting Lodge Marketplace is Highly Competitive in Canada. Clients have many lodge options all with access to lakes with abundant fish stocks, large fish, and reasonable catch limits. Below are some of the operational trends we have observed:

Canadian fishing lodges have a high amount of fixed costs, such as airplane charter and field labour, in their cost structure e.g., the lodge pays the same air charter costs regardless of whether the plane is full or not. Accordingly, a remote lodge will require a very high occupancy rate, 90% or so, to breakeven (including a normal return on investment) while road access fishing and hunting lodges, are often able to turn a profit at occupancy rates below 80%.

Recent years have seen some discounting and predatory pricing by lodge operators. This practice will relieve short term cash flow pressures but at the expense of the long term price structure for the entire industry.

The lodge operations season lasts for five months: from May to September with peak season being June to end of August.

The key to viability for any lodging property is high occupancy rates. One of the major keys to high occupancy in the fishing & hunting lodge industry is repeat business and word-of-mouth advertising. It is not uncommon for a guest, on concluding the current trip, to leave a substantial deposit for next year’s trip. To attract this repeat business requires attentive customer service and niche marketing.

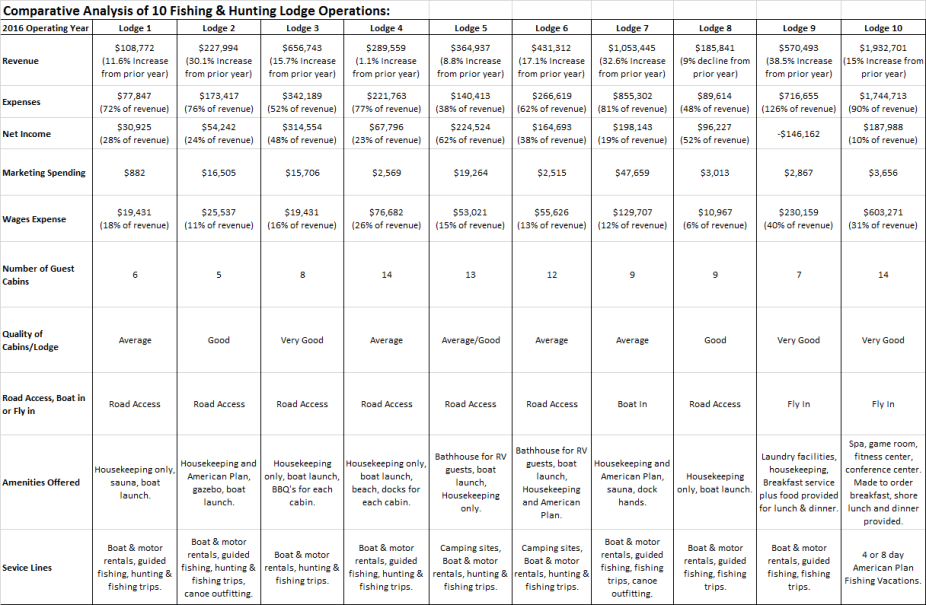

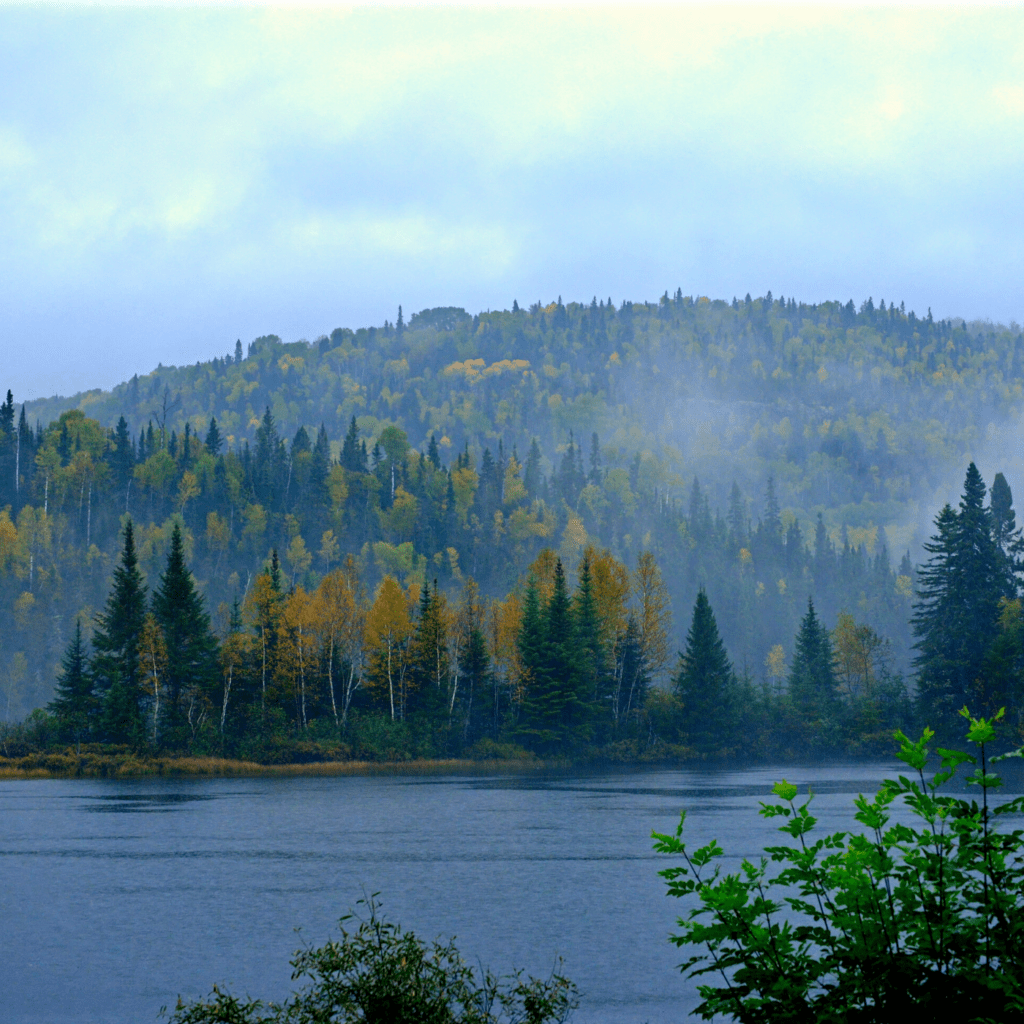

Below we have analyzed 10 fishing & hunting lodge operations based on their 2016 operating year:

Observed Trends in Income/Expense Statements:

- 9 out of 10 lodges analyzed saw an increase in revenues from 2015 to 2016. The average increase was 18.9%.

- Expenses ranged from 38% to 126% of revenue with an average of 72%. Non road access lodges experienced expenses 80% + of revenue.

- Net Income ranged from 10% to 62% of gross revenue.

- 50% of earned less than $100,000 net income.

- Marketing/Advertising spending ranged from $882 to $47,659 with an average of $11,464.

- Wages expense ranged from 6% to 40% of revenue with an average of 19%.

- Average number of guest cabins is 10.

Lodge owners can utilize this information by comparing and contrasting the above percentages with their own operations. Make particular note of the low expense ratios some operations are obtaining.

Estimating Market Value of a Fishing & Hunting Lodge Via Multiples of EBITDA

Fishing & hunting lodges generally evidence many of the same characteristics as hotels.

These assets contain business components as well as real estate, are labor intensive operations, and are subject to volatility in their income streams because they must release their rooms 4 to 8 days. This is unlike more traditional income-producing assets, which derive income through fixed-term rental revenue, fishing & hunting lodges are constantly subject to the whim of the consumer.

In appraising fishing & hunting lodges for what is referred to as their “value in use”, the professional appraiser has several options to choose from.

The income capitalization approach analyzes the lodge’s ability to generate financial returns as an investment. Inherent to the income approach is the principle of anticipation, where purchase price is formulated on the expectation of future net operating income and property appreciation.

An income capitalization approach commonly utilized in the valuation of fishing & hunting lodges is the application of an EBITDA Multiplier (earnings before interest, taxes, depreciation and amortization).

In order to value a fishing & hunting lodge by the application of an EBITDA multiple, transactions involving other fishing lodges must be researched to derive overall capitalization rates and EBITDA multiples of properties that are similar in any of these categories: facilities, physical condition, market orientation, and profitability.

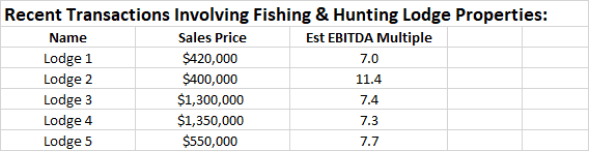

Below we have presented recent transactions involving fishing & lodges in Canada and displayed a sample calculation.

The following chart details these transactions including sales price and EBITDA multiple:

In the review of rates of return derived from the preceding transactions, the EBITDA multiples derived from historical net incomes ranged from 7.0 to 11.4 with an average of 8.16.

This is a small sample size but it is considered reflective of what we are seeing in the overall fishing lodge marketplace and the EBITDA multiples have remained relatively consistent for several years. In the above sampling Lodge #2 is pulling up the overall average of the sample. The majority of fishing lodges are trading in the low 7’s for a multiplier.

In order to estimate the market value of your fishing lodge you will need to determine a stabilized net income amount and multiply by an appropriate EBITDA multiple. We recommend using a multiplier of 7.3 for your calculations, this is the most common found in the fishing lodge marketplace, go higher if your lodge is a higher quality operation and vice versa.

Below is a sample calculation utilizing the net income from Lodge 7 in our comparative analysis above, and a 7.3 EBITDA multiple to determine an estimate of market value for this fishing lodge:

The indication of the value in use for the above fishing lodge derived via the EBITDA multiple analysis is $1,450,000.

The above example isn’t considered gospel. In reality there is a wide range of potential EBITDA multipliers that Fishing lodges are obtaining, but the above estimates would be reflective of an average operation.

It is important for lodge owners to have a rough estimate of the market value of their business and assets. This will aid them with an “exit” strategy which is the number one thing most business owners overlook.

Below we will examine ways that some fishing lodges are increasing their revenue which also increases your lodge’s value.

Section 5: Creative Ways Lodges Are Increasing Their Revenue

Below are some of the ways we have seen lodge owners deal with the aforementioned industry hiccups and increase their revenue during tough economic times. We hope this will be helpful to you and you will rethink your business the next time the tourism industry slows down:

Finding More Favorable Loan Terms and Conditions:

The majority of the lodges we have visited have been in the owner’s family for a significant amount of time and have significant equity built up in the property.

When business revenue was sagging, these lodge owners were able to leverage their significant equity built up in their lodge operations and negotiate better monthly terms due to the low loan to value ratios.

By obtaining more manageable monthly payments, they were able to create that extra bit of breathing room every month as they waited for the tourism industry to turn around.

Alternatively, instead of refinancing the whole mortgage, a lot of lodge owners have also done equity take out loans to invest in aging infrastructure and marketing campaigns.

Subdividing Excess Land and Selling Off as Cottage Lots:

Disclaimer: You will need to consult with your local zoning bylaw and any development restrictions that may be in place.

During the recent fishing lodge industry slowdown, some lodge owner’s made use of their excess land that was not necessary to their operation.

The lodge owners went through the proper channels to subdivide this excess land and create valuable cottage lots which were then sold off. Some even went so far as subdividing the excess land and developing cottages before selling them off.

Often times the buyers were past American guests of the lodge that lived a good distance away and did not make it to the cabins often. The lodge owners then offered to serve as property managers for these cabins which spent most of their time as short term rentals.

The lodge owners made the profit from the sale and also added a revenue stream by managing the properties on an ongoing basis.

Attending More Trade Shows:

Some lodge owners decided to take matters into their own hands and doubled the number of trade shows they attended during the “off season”.

Lodge owners that did this reported earning back enough additional revenue from the increased number of guests to cover the cost of the trade shows plus some additional revenue.

These lodge owners felt that the real payoff will be in earning the repeat business of these new guests.

Increasing Online Presence and Social Media:

We spend a lot of time on all sorts of fishing lodge websites. Odds are that if you are a fishing lodge owner we have visited your website.

There is a very clear trend in the industry of improving the quality and quantity of the lodge’s online presence.

Most lodge’s client lists are aging and if you want to attract new generations of fisherman, it is important to go where they are, which is online.

Some lodge owners have implemented Instagram accounts into their marketing strategies. Instagram couldn’t be a more perfect place for lodge owner’s to show off big catches and the picturesque scenery of their resort.

Lodge owners have also recognized the need for a high quality website and the importance of generating regular content for that website.

Email Marketing:

Most lodge owner’s started collecting their guests email addresses many years ago, but only a few lodges started implementing email marketing into their strategy to increase revenue.

The lodge owners that regularly touched base with their old guests throughout the winter (showing them pictures of what’s been going on at the lodge, sending blogs, etc) retained a significantly higher percentage of guests than those that waited to hear from their guests.

I’m sure all of your guests would love to hear from you, so start crafting a regular email just to say hello.

Facebook Custom Audiences:

As discussed above, staying “top of mind” is very important in an industry with so many competitive options.

Facebook gives you the ability to create a “custom audience”. Some lodge have uploaded their former guest email list to Facebook to create a custom audience. Facebook will match all accounts with those email addresses. This always you to create an extremely targeted ad campaign directed entirely at former guests.

In order to grow your client list, you can create a “lookalike audience” of your former guest list. This will create an audience to run ads at that share similar interests to your custom audience.

Public Dining Restaurant:

This is obviously not an option for very remote lodge operations. However, some of the road access and boat access fishing lodges on more “well-travelled” lakes or in close proximity to a town, have opened up their dining rooms to the general public with some success.

No longer is dining in the main lodge just an option for those American Plan Guests. Lodges often have a lot of food waste. By opening up the lodge to the public, those extra meals that may have turned into waste have become an extra few dollars that add up over the course of a summer with no additional effort.

Diversifying the Company Profile:

I have seen lodges successfully diversify their business operations to include additional revenue sources such as: dock construction services, cabin construction services.

This was discussed above, but lodge owners often have the inside scoop on what is happening in their nearby cottage country. Some lodge owners have capitalized on cottages that were available at a discount and could be resold or were prime for redevelopment. Others have purchased prime land that will later be subdivided and sold off as cottage lots.

Offering Long Term Rentals:

There have been many instances where highway road construction crews were working in the area of fishing lodge operations.

The lodge owners were able to capitalize on the situation by renting out some of the cabins for the entire summer to the crews. The Ministry of Natural Resources and its employees also occupy cabins on a seasonal basis at some lodges.

Killing Off the Revenue Drainers:

Could you potentially sell one off one of your outposts and increase bookings at the remaining outposts?

The more buildings and cabins your operation has, the higher your repairs and maintenance costs will be maintaining these structures.

Usually the case is one of the outposts is severely under-performing in comparison to the rest.

You have to be willing to “kill off your darlings”. What does “kill your darlings” mean? It is a writing saying, meaning that we should be willing and prepared to kill our favorite characters if doing so is beneficial to the overall story. More lodge owners should apply this thinking when it comes to their business decisions.

Section 6: Fishing & Hunting Lodges For Sale Across Canada

Visit the below links to view fishing & hunting lodges for sale in each province or territory:

- British Columbia Fishing & Hunting Lodges For Sale

- Alberta Fishing & Hunting Lodges For Sale

- Saskatchewan Fishing & Hunting Lodges For Sale

- Manitoba Fishing & Hunting Lodges For Sale

- Ontario Fishing & Hunting Lodges For Sale

- Quebec Fishing & Hunting Lodges For Sale

- East Coast Fishing & Hunting Lodges For Sale

- Yukon Fishing & Hunting Lodges For Sale

- Northwest Territories Fishing & Hunting Lodges For Sale

- Nunavut Fishing & Hunting Lodges For Sale

Section 7: The New Angler Profile

The Survey of Recreational Fishing in Canada by The Department of Fisheries and Oceans collected information about recreational fishing activities to assess the economic and social importance of recreational fisheries to Canada’s provinces and territories.

This nationally-coordinated study provides the most comprehensive information on recreational fisheries activities and harvests in all regions of the country. It is also the most up-to-date source of detailed statistics on the economic contribution made by anglers at both provincial/territorial and national levels.

Below is the angler profile determined through the research:

Income Level

The most commonly reported household income for all overnight sport fishing travellers was $100,000+.

Education

Overnight sport fishing guests in all groups were most likely to report that they had completed post-secondary education.

Canadian Resident Vs Non Resident

The majority of active anglers were residents fishing within their home province or territory (over 2.7 million). The remaining active adult angler population consisted of just over 147,000 Canadian non-residents (fishing outside their home province or territory) and visitors to Canada (approximately 406,000).

Gender

Male anglers made up 73% of resident adult anglers, 83% of Canadian non-resident anglers and 88% of all other non-resident anglers.

Age

The average male angler was 51 years old whereas female anglers were generally 47 years old, compared with 46 and 43 years, respectively, ten years ago. Anglers from outside Canada were noticeably older than either resident or Canadian non-resident anglers, with males averaging 56 years and females 54 years of age. Analysis of the age distribution reveals the aging population of active anglers in Canada.

Section 8: Industry Trends Going into 2018

There are some notable trends in the fishing/hunting lodge industry that are having an impact on lodge operations across Canada. These trends are discussed below:

The Need to Target Younger Angler/Hunters:

Lodge owners are aware that they need to attract younger anglers and hunters to accompany their loyal, older guests. Focusing on the multi-generational trip and actively recruiting older anglers to bring children and grandchildren.

Lodge owners stated that multi-generational trips are an important segment for lodges because it targets an already converted loyal customer, offers a new experiential take on the fishing experience, and expands their customer base.

Anglers and Hunters are Taking Shorter Trips:

Lodge owners have stated that anglers have less leisure time and are requesting shorter trips. It was standard in the industry to offer 7-10 day trips in the past, now a four-day trip is one of the most common.

Female Guests:

Numerous studies point to the largest growing segment in the recreational fishing sector is women. The RBFF in the US has done extensive research into woman and fishing and estimates that there are 69 million women fishing in the United States.

The Canadian TAMS research also identified a large segment of women that are active travelers and enjoy outdoor adventure activities.

Anglers are Becoming More Price Sensitive:

In the past, anglers were wealthy, sophisticated, boomers that wanted all-inclusive packages with luxury accommodations and fine dining. With the downturn of the US economy and the resulting fewer American anglers, lodges have had to keep their prices in line in order to remain competitive.

Cost Pressures are a Concern:

Fishing and hunting lodges have had to keep their prices in line while the industry has faced increasing costs of fuel, air charters, and insurance in recent years.

These are increased costs that lodges and resorts often cannot pass on to the customer. Improved operational efficiencies are needed. However, the potential to achieve efficiencies is often limited for remote locations.

Nature of Repeat Business:

Most Anglers and Hunters are creatures of habit, they like to take their trip at the same time each year, same group, and fish and hunt in the same spots.

Lodge owners estimate that they received anywhere from 70-90% repeat business. They went further to suggest that much of their new customers are anglers coming from referrals from existing groups.

The fishing experience evolves for repeat anglers. When they come for the first time they are in search of big fish and the second time they are looking for the experience and seeing the familiar faces at the lodge.

Many lodges have reported that the nature of their repeat guests has changed. Anglers and hunters are no longer coming for their annual fishing/hunting trip to the same lodge, they are now coming every 2 or 3 years.

Lodges are being forced to market and expand their customer base in order to maintain the same level of business.

Lodge owners have also indicated that guests are taking longer to plan their trip with a shorter booking time. In the past guests would plan their trip a year in advance, often rebooking for the next year at the end of their current trip.

This means lodges now have to keep top of mind for the potential guests for a longer period and also provides less certainty on occupancy numbers until closer to the season.

Importance of Catch and Release:

The majority of fishing lodges have strict catch and release policies in place. Most lodges catch smaller fish for a shore lunch with larger fish being released.

Some lodges that are promoting catch-and-release angling are purchasing local fish from commercial sources. The lodge provides the processed fish at no additional charge to its catch-and-release clients. This is a good solution considering the potential consequences of over fishing to the lodge’s future business.

In Northwestern Ontario, legislation was recently passed reducing the walleye and trout limits for non-residents only. This has an obvious impact on lodges in the area with a large American clientele. The above noted solution could be a good option to implement for lodges in this area and any others that face this problem.

Guests that we interviewed appreciated the catch and release policies lodges were implementing and wanted to take part in preserving the fishery for future guests and angling generations to come.

Renovations and Upgrades:

We’re seeing a lot of the lodge inventory being updated/renovated as lodge owners are recognizing that their guest’s tastes are changing.

With the improvement in revenue for many lodges the past few years, most are taking the opportunity to upgrade and expand their infrastructure.

One lodge owner stated as soon as he was getting new cabins built and ready they were being booked solid. 80% of lodge owners interviewed have made capital expenditures in past two years, 60% spent money on facilities.

Attracting Urbanites:

Getting urbanites to fish poses a tall challenge. More and more North Americans live in big cities. Generations of people are growing up in urban environments and are not as connected with the outdoors as they once were.

There has also been a decline of face-to-face social camaraderie that was traditionally fostered among neighbours, friends and family, the type of camaraderie that characterizes the sport of fishing.

The development of urban fishing programs could be an important source of anglers for Canadian Fishing Lodges in the future.

Final Observations

The thought of owning and operating a fishing & hunting lodge is an intoxicating dream that many outdoorsmen and women fantasize about. But this industry is as unforgiving as any, especially to owners who are not prepared for what it takes to run a successful business. The successful lodge operators enter every year with a detailed plan.

The Canadian fishing lodge sector is a high risk, high cost industry that operates in a very competitive environment. It is subject to regulatory and government uncertainty, and faces several daunting cost pressures and unfavourable currency fluctuations.

Owners must be aware of the current environment in the fishing lodge industry, as well as the tourism industry as a whole. They must also stay on top of current and future exchange rates and the health of the global economy (America especially).

Canadian fishing & hunting lodges have a strong global market position. The trend for Canadian lodge owners has been positive in recent years and preliminary data for 2018 shows another year of moderate growth.

There is no doubt that Canada has premier wilderness destinations to offer clientele. More and more tourists are seeking out nature and the thrill of exploring remote wilderness areas around the globe.

This report analyzed the fishing lodge industry from several angles; we first looked at tourism in Canada as a whole, we then looked specifically at the fishing lodge sector, we explored differentiation tactics, analyzed several lodge operations, compared fishing lodge listings across Canada, detailed the target market, and finally discussed the latest trends in the industry. Below we’d like to offer lodge owners some final observations and recommendations:

- Lodge operators are optimistic for the first time in a long time with 60% of lodge owners interviewed expecting continued business improvement over the next 5 years.

- The industry is beginning to transition. There is still a significant amount of experienced, knowledgeable lodge owners actively managing the business, but we have been seeing more transition to children taking over the day to day operation. Lodges are being sold to younger investors and others are in the preliminary planning stages of plotting their exit.

- Higher end accommodations with limited services (ie. housekeeping only) appears to be a winning formula (quality of the fishery & remoteness are important to this formula).

- RV sites are nice additional income that can be added at minimal cost and add very minimal additional work.

- Insufficient marketing investment contributes to poor visitor numbers, which in turn puts negative pressure on investment decisions that refurbish a lodge’s infrastructure. Lodge owner’s marketing efforts must be substantially increased. The marketing budget should be substantially increased to compete with not just other fishing lodges but other vacation attractions.

- There is a very large opportunity if more Canadian angers and hunters can be attracted to spend their vacation budget on an overnight stay at a Canadian Lodge (rather than leaving the country).

- The inherent problem in this, is that most Canadians with the excess funds to pay for what would be considered an expensive getaway, utilize these funds to “break up the winter” and head to a warmer climate with this money.

- A potential way around this is to target higher income Canadian households and businesses with the excess funds for a Canadian remote wilderness lodge getaway in addition to their warm climate getaway. In fact, the lodges that felt the least pain during the most recent dip in the industry, were the lodges that appealed to a higher end clientele.

- We are aware that not all lodges can be 5 star resorts. However, owners should consider operating fewer high quality accommodations at a higher price, rather than many lower quality cabins at a lower price. Slowly replacing the older infrastructure with higher quality cabins is what most lodges have begun doing during the healthier times of the last few years.

Resources:

- Nature and Outdoor Tourism Ontario

- BC Fishing Resorts and Outfitters Association

- Alberta Fish & Game Association

- Manitoba Lodges & Outfitters Association

- Kenora District Camp Owners Association

- Quebec Outfitters

- Canadian Federation of Outfitter Associations

- Tourism Saskatchewan

- Saskatchewan Commission of Professional Outfitters

- Yukon Outfitters Association

- Ontario’s Sunset Country Travel Planner

- New Brunswick Outfitters Association

- Newfoundland and Labrador Outfitters Association

- Spectacular Northwest Territories

- Nunavut Tourism

References:

- Tourism British Columbia – Fishing Product Overview

- Competitive Analysis of the Outfitted Recreational Sport Fishing Sector of the Northwest Territories

- Understanding the economy of Manitoba’s Fishing and Hunting Sector

- Restoring Canadian Tourism, a Discussion Paper

- Fishing Sector Workshop Report

- Sport Fishing & Game Hunting in Canada – An Assessment on the Potential International Tourism Opportunity

- Yukon Outfitters Socio-Economic Profile and Situational Analysis

- Survey of Recreational Fishing in Canada

- Remoteness Sells

- Anglers in Northern Ontario – A Situation Analysis

This article has been prepared by Frontier Hospitality Advisor for general information only. Frontier Hospitality Advisor makes no guarantees, representations or warranties of any kind, expressed or implied, regarding the information including, but not limited to, warranties of content, accuracy and reliability. Any interested party should undertake their own inquiries as to the accuracy of the information. Frontier Hospitality Advisor excludes unequivocally all inferred or implied terms, conditions and warranties arising out of this article and excludes all liability for loss and damages arising there from.

Thank you for this info

I appreciate your feedback Chad, got your email with the other things you would be interested in learning more about and we will aim to deliver.

Thank you for sharing Bryce. I have shared this report with our Territorial DMO. This report has got some comentary that we will be discussing in the next few weeks. Take care. – Gord

Thanks Gord, I appreciate the feedback, check out reference number 1 it was a very useful resource that is NWT specific.

Great info, thanks for sharing!

Thanks Lydia, hope you’re having a great season!

Great article, I shared it with my counterparts at the BCFROA, but one thing I find confusing is the notion of using a multiple of EBITDA or net income, to determine the total value of a lodge. I would have thought other important factors such as land value and assets would come in to play, and then on top of that some multiple based on business value, i.e. sustainable net income as a percentage of revenue. If only using a multiple of net income it does not matter if the lodge sits on leased or freehold land or on 2 or 20 acres etc.

Very insightful question Kevin, and your comment is correct in alot of circumstances. What the article doesn’t explain well is the final step in the valuation process after completing at least 2 of the 3 valuation methods (often income approach and sales comparison approach for lodges) comes the reconciliation and correlation of the value indications.

Factors that are considered in assessing the reliability of each approach include the purpose of the appraisal, the nature of the subject property, and the reliability of the data used. In the reconciliation, the applicability and supportability of each approach are considered and the range of value indications is examined.

The most significant weight is given to the approach that produces the most reliable solution and most closely reflects the criteria used by typical investors. Obviously situations vary widely when it comes to lodges, you mentioned some of them, leased land, land size, etc. but I often find the appropriate value estimate is between the value of the assets and the income approach, not necessarily with one method or the other, which is essentially what you explained.

Thanks for your feedback and hope you’ve had a great summer!